06 Feb Why I Run My Personal Finances Like A Business

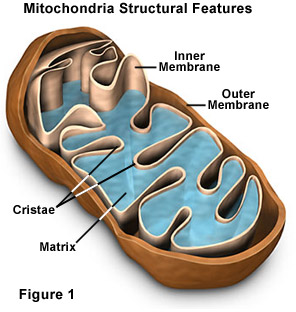

I still remember it like it was yesterday. The mitochondria. The powerhouse of the cell. Why did that lesson stick with me from middle school biology? I don’t know. Maybe it was the idea that most of the cells in my body have tiny batteries to keep it going which was a pretty crazy concept to a lower-middle class kid who spent his free time playing outdoor basketball and Goldeneye on Nintendo64.

But you know what else would have been a mind-blowing concept at that age for an average kid from Florida? Compound interest. Riddle me this…which would you rather have?

- $1 Million right now OR

- The total of 1 cent doubled every day for 30 days

No. It’s not a trick question. Just one that requires a little math and perspective. I’ll save you the math and give you the answer, but the perspective is important.

$5,368,709.

That is how much money you would get if you went the penny route. That is the power of compound interest. That is life-changing information for many if expanded upon in the context of our educational system.

Imagine if you taught kids that they could harness that power (not exactly at that sustainable of a rate) and they could use it to create wealth and live a life they probably haven’t even dreamed up yet. Then, imagine if you kept teaching that lesson in more detail every year of school until graduation. Do you think people might make different money decisions than they do now? I do. I really, really do.

But we don’t. Instead we teach of the awesomeness of the mitochondria. And financial education as part of the curriculum in schools is a pipe dream and discussion for another day. For now, we will have to rely on self-education and to be blunt, not many of us make that a priority. Interestingly enough, basic algebra is all the math you need to become a financial guru. However math isn’t enough. You need to understand the rules of money as well and most have never been taught that. Just because I give someone a hammer, nails and wood planks doesn’t mean I expect them to be able to build a solid house. Yet isn’t that what we expect people to do with their personal finances!

But we don’t. Instead we teach of the awesomeness of the mitochondria. And financial education as part of the curriculum in schools is a pipe dream and discussion for another day. For now, we will have to rely on self-education and to be blunt, not many of us make that a priority. Interestingly enough, basic algebra is all the math you need to become a financial guru. However math isn’t enough. You need to understand the rules of money as well and most have never been taught that. Just because I give someone a hammer, nails and wood planks doesn’t mean I expect them to be able to build a solid house. Yet isn’t that what we expect people to do with their personal finances!

After changing majors, I ended up graduating with a degree that had no bearing on my career but got me in the door to interview for some jobs where it was the minimum requirement. A few years later, I went back and got my Accounting degree even though my job was in sales and marketing. It was one of the best things I’ve ever done.

Take a quick trip down memory lane with me. Two months before graduating college, I’m on the phone having a mild panic attack. I’m speaking with the HR manager after accepting a job for my first-ever career and she starts speaking a different language from anything I’ve ever heard before. She said strange things like “401k”, “Employee Stock Purchase Plan” and “HSA Allocation”. I would’ve done better on a pop quiz of Egyptian heiroglyphics. After that traumatic experience, I broke a few speed limits to get to my local bookstore (Amazon Prime wasn’t a thing yet and I still don’t think I could’ve waited two days anyway) and began my self-education on personal finance.

Now, fast forward six years after I got my second degree in Accounting. I was married and we had some significant student loans that hovered well over six-figures. From the start of our marriage, we put in a serious plan to get out of debt. We got our debt-income ratio down to acceptable levels. Then we started investing where we were confident our money could outperform our consolidated and negotiated interest rates down. We did this successfully while still aggresively paying down debt. Finally, December 31, 2017, we were debt free (mortgage not included)!

Now, we are doing more than just investing the capital we have lying around every month. We depreciate our assets and have separate “savings accounts” for car maintenance and eventually down payments on replacement vehicles. We have invested in local businesses, the stock market and started paying down our mortgage more in case we want to take advantage of a HELOC (home-equity line of credit) or keep our debt-income ratio down. We maintain a healthy line of credit while paying it off bi-weekly to avoid interest payments. This enables us to take advantage of cash rewards and the security of credit card benefits compared to debit cards.

Many things I mentioned above would be lost upon the average American and that’s a sad reality. Over 63% of American’s can’t cover a $500 emergency with cash. Why are we shocked? Money is the most important concept we can learn about yet we’d rather mandate students learn about the Pythagorean theorem instead of proper budgeting skills (the former has yet to be relevant to me in day-to-day life).

So this is why I run my finances like a business…it’s how I learned. I had to get a second college degree, read over a hundred books and reflect/change my own personal consumeristic behaviors to finally have enough confidence to take my finances entirely into my own hands.

Now, I know money is something I can never truly stop learning about. Like our world, it is constantly changing as technology, markets and taxes evolve. And like a business, I have two choices. I can remain stagnant and eventually go the way of Blockbuster or I can learn, adjust and thrive. Let’s just say, I’m a fan of Netflix.